what items are exempt from sales tax in tennessee

If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along with gift information and. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

How To Register For A Sales Tax Permit In Tennessee Taxvalet

The latest ones are on Jun 19 2022.

. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Some goods are exempt from sales tax under Tennessee. 2022 Tennessee state sales tax.

In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Exact tax amount may vary for different items. This page discusses various sales tax exemptions in.

Clothing with a price of 100 or less per item. Several examples of of items that exempt from Tennessee. Groceries is subject to special sales tax rates under tennessee law.

While the Tennessee sales tax of 7 applies to most transactions there are certain items that may be exempt from taxation. Some exemptions are based on the product purchased. 265 new Tennessee Sales Tax Exempt Items results have been found in the last 72 days which means that every 18 new information is figured out.

School and school art supplies with a price of 100 or less. Currently combined sales tax rates in Tennessee range from 7 percent to 10 percent depending on the location of the sale. Tennessee By Eduardo Peters August 15 2022 August 15 2022 Clerical vestments golf clothing galoshes diapers swimsuits lingerie and underwear pajamas hats.

If you sell any. If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along. What Items Are Exempt From Sales Tax In Tennessee.

During the holiday the following items are exempt from sales and use tax. Therefore no holiday is necessary. By Eduardo Peters August 15 2022 August 15 2022.

The charity organizations such as corporations unincorporated associations or trusts can claim the tax exemptionFor this purpose they have to prepare a form 1023 Application for. A textbook is defined. The sales tax is comprised of two parts a state portion and a local.

What Canadian Businesses Need To. At a total sales tax rate of 9250 the total cost is 38238 3238 sales tax. For example gasoline textbooks school meals and a number of healthcare products are not subject to the sales tax.

As a business owner selling taxable goods or services you act as. Textbooks and workbooks are exempt from sales tax. STH-11 - Textbooks are Exempt from Sales and Use Tax.

Tax Free Weekend In Tennessee 10 Things Everyone Should Buy

Tennessee Non Profit Sales Tax Exemption Certificate

Tennessee Trouble With Sales Tax Holidays Avalara

How To File And Pay Sales Tax In Tennessee Taxvalet

How To File And Pay Sales Tax In Tennessee Taxvalet

Tennessee Sales Tax Handbook 2022

Get Ready To Shop As Tennessee Sales Tax Holiday Begins Friday

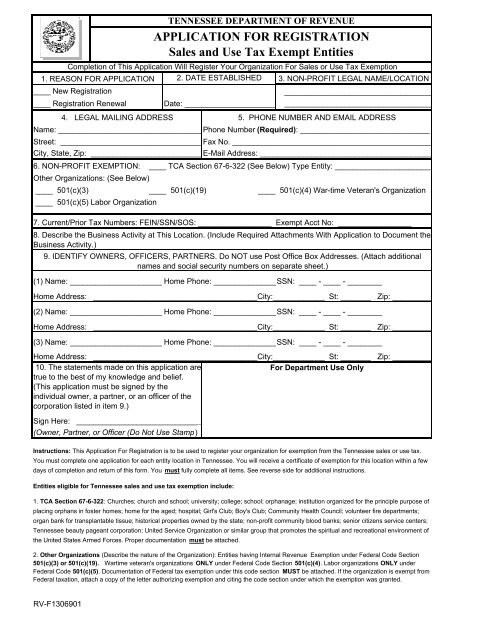

Tennessee Department Of Revenue Application For Registration Sales And Use Tax Exempt Entities Icma Org

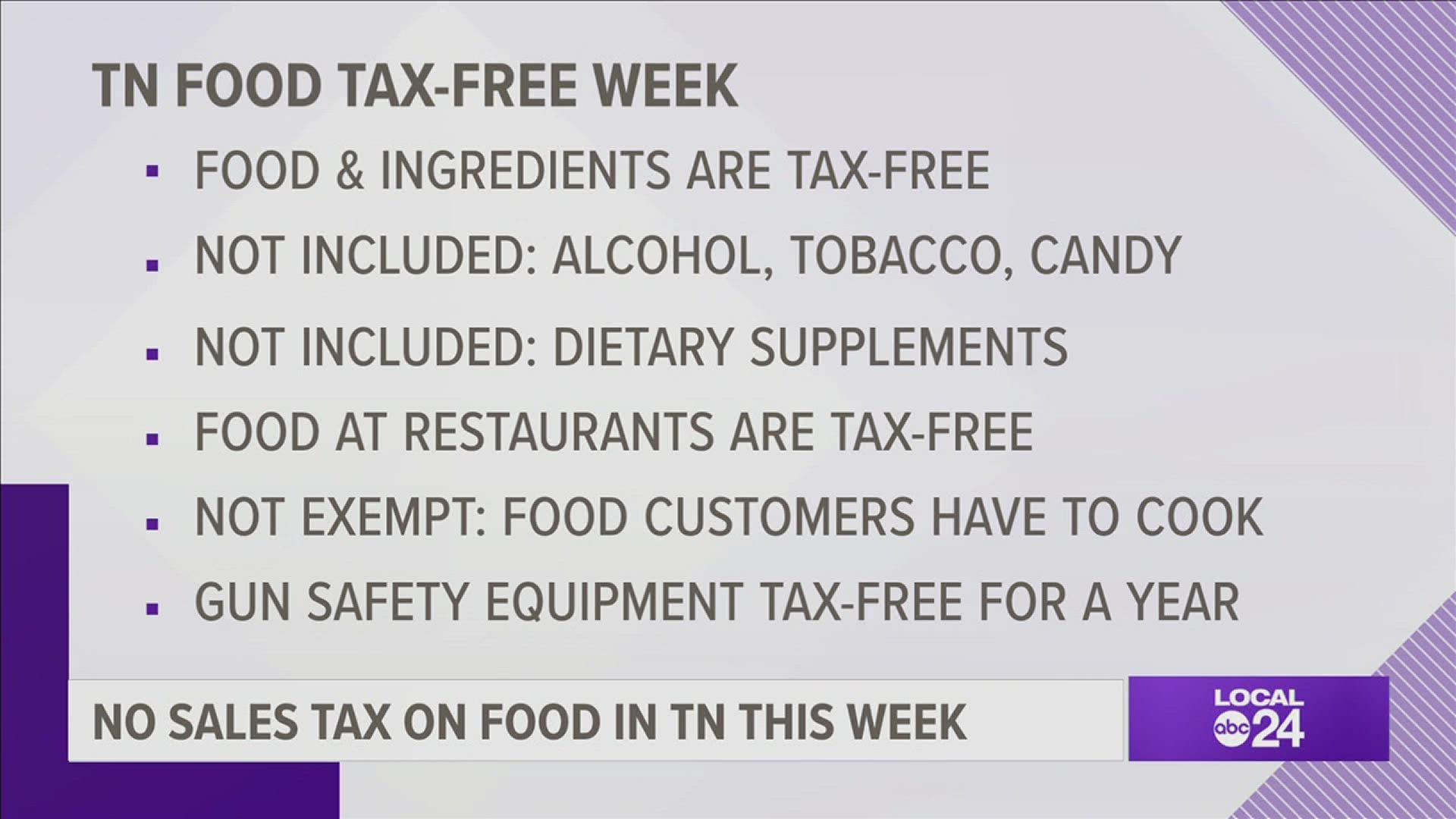

Tn Has Its First Ever Tax Free Week On Food Localmemphis Com

How To Use A Tennessee Resale Certificate Taxjar

Historical Tennessee Tax Policy Information Ballotpedia

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

How To File And Pay Sales Tax In Tennessee Taxvalet

Sales Taxes Across The Nation Arkansas Economist

Tennessee Exemption State Fill Out And Sign Printable Pdf Template Signnow